The Law versus Practical Reality

The American consumer lay completely at the mercy of the credit bureaus. The United States Congress enacted the Fair Credit Reporting Act (FCRA) in 1971 to insure that the credit bureaus investigate the credit items disputed by consumers. This federal law set procedural guidelines, which gave the consumer the right to challenge the accuracy, validity, and verifiability of the credit listings appearing in their consumer credit report. It also required that the credit bureau delete any credit listing if it was inaccurate or could not be verified.

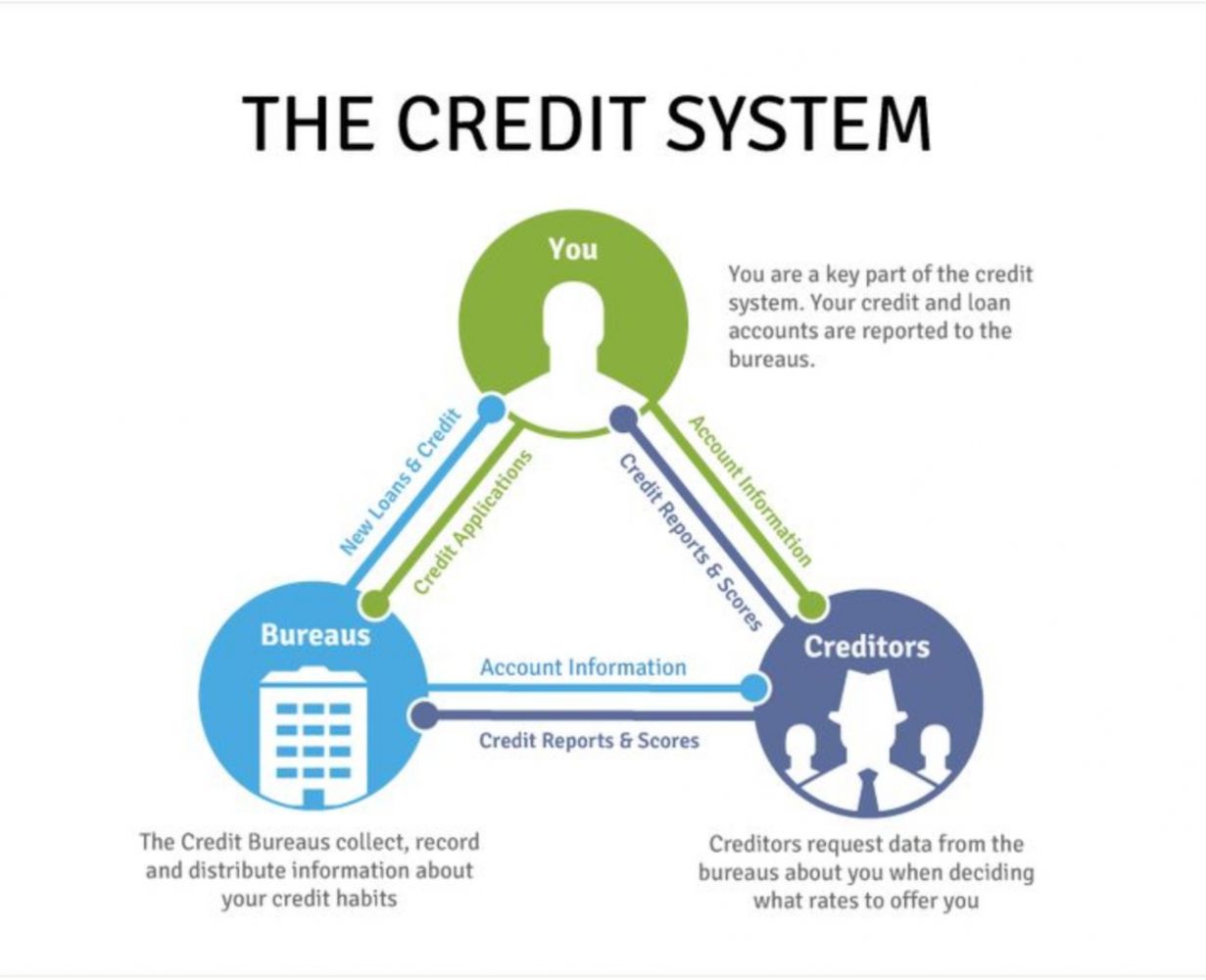

In theory, the FCRA charges the credit bureaus with responsibility to the consumer as well as the credit grantor. In reality, the credit bureaus resist, resent, and reject consumer disputes. The credit bureaus would rather be left alone to make a profit. And, each time a consumer challenges his credit, profit is lost.

The credit bureaus first defend their profits by erecting walls of stall tactics, including requests for more information, further clarification, and additional identification. The vast majority of consumers give up before they even receive copies of their credit reports. If a consumer manages to get a credit report, decipher the codified information, write a coherent dispute, and mail it, the bureaus may still find some reason to disregard the challenge. The entire dispute system is designed to frustrate and discourage the consumer.

Many consumers have the idea that the credit bureaus must complete their investigation within thirty days or be forced to remove all disputed information. They threaten to sue the credit bureaus if they don't conclude their investigation in time. In practice, such thinking is delusional. Nobody forces the credit bureaus to do anything. However, if you manage to submit a valid dispute letter, and the credit bureau investigates your dispute, the chances of success are good.

If a credit bureau cannot verify an item before completing its investigation, that item will be removed. Many creditor grantors are simply reluctant to take the time to verify the data. While the credit bureaus are in the business of reporting credit histories, creditor grantors are not.

Many consumers have the mistaken idea that credit bureaus are federally supported organizations backed by a vast array of laws meant to protect creditors. Nothing could be further from the truth. Aside from the government simply recognizing the need for credit reporting, credit bureaus have absolutely nothing to do with the government. Credit bureaus are simply huge bureaucratic companies which exist for the soul purpose of making money by selling information about you-information they never bothered to verify.

Because of the vast potential for error in the credit reporting system, the United States Congress has enacted laws to protect the consumer from being victimized by the credit bureaus. It is your right and responsibility to make use of these laws.